National News

Opposition in Bihar was postponed till 2 pm amid opposition protests on head

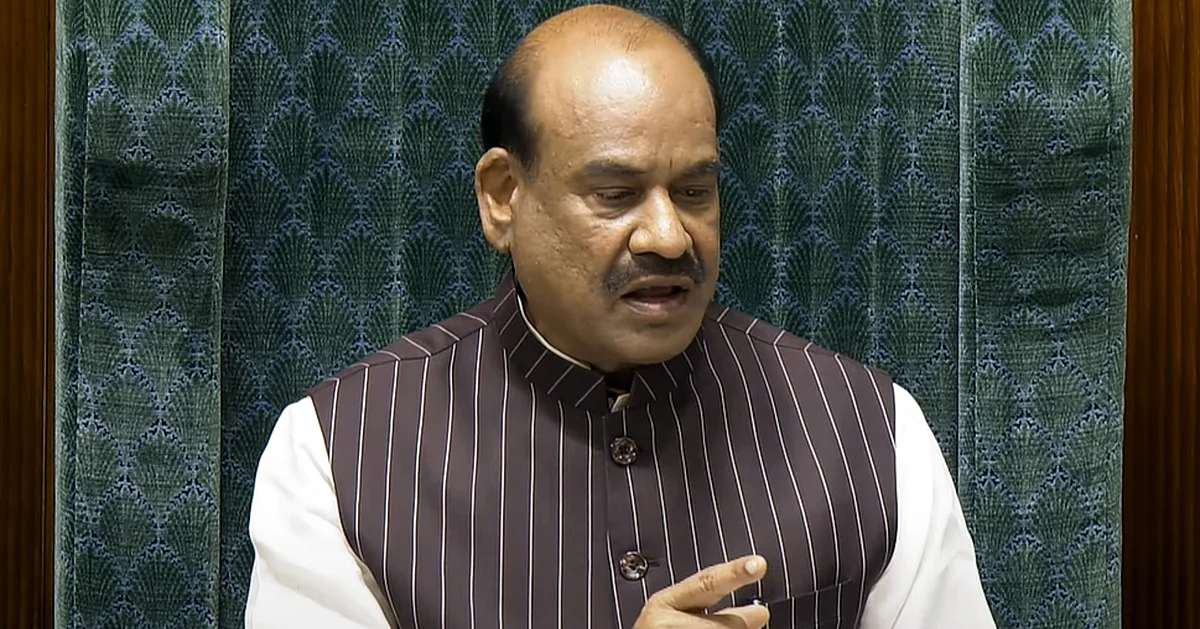

The Lok Sabha witnessed noise scenes and disruption for the third consecutive day of the monsoon session on Wednesday, 23 July, as opposition members continued protest against the amendment of the electoral rolls in Bihar.

Opposition members created a storm in the well of the House during the time of question, waving and raising slogans, which led to the adjournment of proceedings by 12 noon.

Similar scenes were played when the House re -acted and BJP leader Sandhya Ray, who was on the chair, postponed the proceedings till 2 pm after laying parliamentary papers and two bills of the Ministry of Sports.

Opposition members raised slogans like “Sir Vepus Low (Roll Back Sir)”.

The opposition is demanding a discussion on the special intensive amendment (SIR) of the electoral rolls in Bihar, which is a practice started by the Election Commission before the state assembly elections later this year.

National News

BRS suspended MLC K. Kavitha for anti -party activities

He also claimed that the assured Chief Minister A. Revanth Reddy was behind Harish Rao and Santosh Kumar.

Kavita has been making important comments against some party leaders for several months now without giving her name. She is organizing political activities under the banner of ‘Telangana Jaggruti’, a cultural organization.

Internal differences within the BRS emerged for the first time in May this year, with the exception of a letter from Kavita, KCR wrote about the party’s matters leaking.

He then said that some conspiracy is being hatched in the party, and KCR is “like a God who is surrounded by some devils”.

Responding to his comments then KT Ram Rao, brother of Kavita and working president of BRS, said that the matters of the internal party should be discussed within the party boil instead of publicly speaking.

In August, Kavitha was removed as an honorary chairman of the BRS-Buddhist Trade Union at the state-run coal mining company Singareni Collaries. On his expulsion as the honorary president of the Sangh, Kavita exceptioned the exception to his replacement by a new leader.

National News

MLA who blamed his government for the floods booked for rape, ran away amid gun bullet

On Tuesday, in a dramatic turn of incidents, Punjab Aam Aadmi Party (AAP) MLA Haratit Singh Pathanmajra survived police custody on Tuesday after being booked in rape case, injured with an SUV with an SUV with sources claiming gunshots during the incident.

Sources said the Sanore MLA, who had recently been vocal against its party leadership, was allegedly assisted by supporters while allegedly escaped.

Efforts are underway to locate Pathanmajra. Senior Superintendent of Police Varun Sharma was unavailable for the comment.

Earlier in the day, Pathanmajra appeared in a video on Facebook stating: “They can do an FIR against me, I can stay in jail, but my voice cannot be suppressed.” He claimed that he was incorrectly booked in rape charges and accused the AAP’s central leadership of extreme intervention in the rule of Punjab.

According to the FIR registered on the complaint of a woman from Zirakpur, Pathanmajra faces allegations of rape, cheating and criminal intimidation. The complainant alleged that the MLA incorrectly presented himself as divorced and entered a relationship with him, later married someone else in 2021, while still legally married.

He further accused him of repeatedly sexually abusing, threatening and sending his pornographic material.

In its social media video, Pathanmajra said in Delhi in Delhi, “Delhi -based AAP leadership is illegally rule over Punjab.” He urged fellow MLAs to stand with them, claiming that such a central intervention never occurred under the previous Congress or BJP governments.

National News

Why Consensus Center depends on compensation states

As the GST Council calls for a two -day meeting tomorrow, the fastest point of the dispute will not be the Prime Minister’s Diwali deadline for the “next generation” reforms, but the question of how the states will be compensated for the proposed comprehensive changes.

Improvements may be promised to simplify the tax structure and low rates on essential commodities and services, but state governments are afraid that they will have to struggle with lack of adequate revenue.

At the center of the case, Prime Minister Narendra Modi’s commitment to start a new GST regime by 2025. The proposed overhaul includes compressing the current four-level structure in two major slabs of 5 percent and 18 percent while maintaining exemption on essential food, medicines and education.

In addition, a high 40 percent rate is to be planted on sin and luxury goods, which covers items such as alcohol, tobacco and cigarettes. While the Center frames the move as a “Diwali gift” to reduce prices to consumers and MSMEs and simplify compliance, states have argued that the actual cost will be borne by them.

Many items are expected to shift up to 12 percent from slabs to 5 percent and 28 percent from slab to 18 percent, state governments will come for sharp contractions in tax receipts.

Opposition ruled states, including Kerala, Karnataka, Tamil Nadu, West Bengal, Punjab, Jharkhand, Telangana and Himachal Pradesh, have warned that the proposed rationalization can strip between Rs 85,000 crore and Rs 2 lakh crore annually from their treasures.

These estimates are for 15-20 percent erosion of their GST revenue base. Telangana alone suffers a loss of Rs 7,000 crore.

The compensation end of compensation cess in March 2026 has intensified the demands for an alternative mechanism. Using 2024–25 as the state base year, the minimum five-year-old compensation are pressurizing for guarantee, and the protection of at least 14 percent revenue increase per year that reflects the conditions in the first five years of GST.

Without such security, finance ministers have warned that important welfare schemes, infrastructure projects and development expenses will be compromised.

-

IPL3 months ago

IPL3 months ago‘Any nahhi numba hai’: Furious MS Dhoni loses cool, CSK shouts at players – Watch. Cricket news

-

Sports3 months ago

Sports3 months ago‘Is MS Dhoni fit or not?’ Cricket news

-

IPL3 months ago

IPL3 months agoExplained: Why Punjab Kings will get two opportunities to reach IPL 2025 final

-

IPL3 months ago

IPL3 months agoAnil Kumbal on Shubman Gill: ‘Captaining India is different from the captaincy of a franchise’. Cricket news

-

IPL3 months ago

IPL3 months agoIPL 2025: Hardik Pandya hit the unique ‘Triple Century’ in T20S.

-

IPL3 months ago

IPL3 months ago‘No, you can’t take it …’: Shreyas Iyer’s bold statement. Cricket news

-

National News3 months ago

National News3 months agoIndian Youth Congress started fellowship program for young lawyers

-

Sports3 months ago

Sports3 months agoHow Rohit Sharma’s bad form with BAT is damaging Mumbai Indians’ IPL 2025 campaign